Assistance in obtaining a certificate of absence of foreign currency assets outside Ukraine

| Service name | Timeframe | Price (UAH) |

|---|---|---|

| Certificate of absence of foreign currency assets abroad | 3 business days | 600 |

Certificate of absence of foreign currency assets abroad may be required if you decide to engage in foreign economic activity. The certificate can be obtained by enterprises (individual entrepreneurs and other legal entities) that do not have property or foreign currency assets outside Ukraine. This document may be needed for submission to customs authorities during customs clearance of goods for export or import.

Process of obtaining the certificate of absence of foreign currency assets:

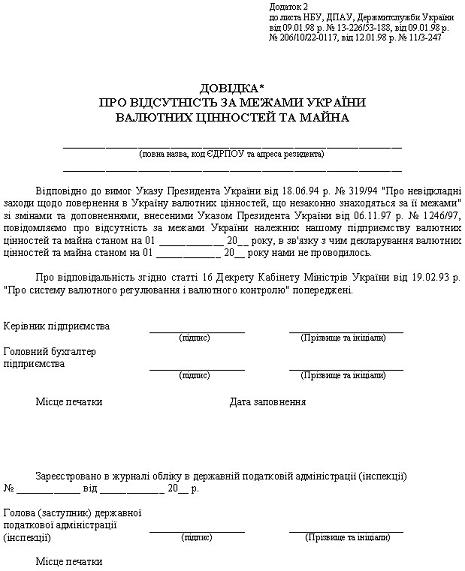

- Filling out 2 copies of the form of the prescribed sample by the foreign economic activity entity (The form of the certificate is approved by the joint letter of the State Tax Administration of Ukraine (GNAU), the National Bank of Ukraine (NBU), the State Customs Service of Ukraine No. 206/10/22-0117 dated 09.01.98, No. 13-226/53-188 dated 09.01.98 and No. 11/3-247 dated 12.01.98 “Regarding the submission of the Declaration on foreign currency assets and property”);

- Submission of the completed copies to the currency control department at the State Tax Inspectorate (GNI) with subsequent registration in the certificate log;

- Receiving back one copy with a stamp and signature.

IMPORTANT TO NOTE, that when submitting the certificate, besides the two completed copies nothing else is required (no lease agreements, diplomas, reports and similar documents, contracts). Quite often the GNI authorities may additionally require filing an empty currency declaration, which is also not mandatory and in many cases may, on the contrary, be a reason for refusal to issue the certificate of absence of foreign currency assets. These matters are mutually exclusive, because in that case you will only be able to obtain a certificate of declaration of foreign currency assets.