Filing of accounting and tax reports

The filing of reports by specialists from the company “Nakaz” includes the following services:

- thorough analysis and verification of the company’s primary documents;

- verification of the correctness of payroll calculation for the reporting period;

- preparation of reports (financial statements and tax reports);

- submission of reports to the relevant authorities electronically.

Tax and accounting calculator, we prepare reports and figures based on the data you provide, etc.

Preparation of primary documents, bank maintenance, communication with counterparties, etc.

Complex non-standard tax and accounting operations, VAT, fixed assets, dividend payments, etc. Training, consultations, development of documents and work schemes, tax planning, everything that requires individual immersion in the Client’s business.

Large turnovers or transactions, complex operations, risky decisions, complex VAT and large fixed assets.

The service is provided by the company “Nakaz” on an ongoing basis or as a one-time service. The report filing service can be provided as part of accounting services or separately.

The cost of filing reports depends on the number of services provided by the legal company. In each case it is agreed contractually. On average, the full range of services for preparing and filing reports costs from 5000 UAH.

| Name of tax | Report submission deadline (calendar days) |

| Corporate income tax Section III of the Tax Code (NKU), Section XX, subsection 4, Section III, articles 133-142 of the Tax Code | Reporting period: – year – applies to enterprises whose income (excluding indirect taxes) for the previous year does not exceed 20 million UAH. The deadline for filing reports is 60 days after the end of the period; – quarter – for enterprises whose income (excluding indirect taxes) for the previous year exceeds 20 million UAH, except newly established enterprises and producers of agricultural products. Filing deadlines: for the 1st quarter, half-year, 9 months – 40 calendar days after the end of the period; for the year – 60 days after the end of the period. |

| Personal income tax Section IV articles 168, 177 of the Tax Code (NKU) | Reporting period: 1) Legal entities and tax agents of individual entrepreneurs (FOP) – quarter; 2) FOP on the general system* – year. Exception: newly registered or those who switched from the simplified system – quarter (one-time). The filing deadline for all – 40 days after the end of the reporting period. |

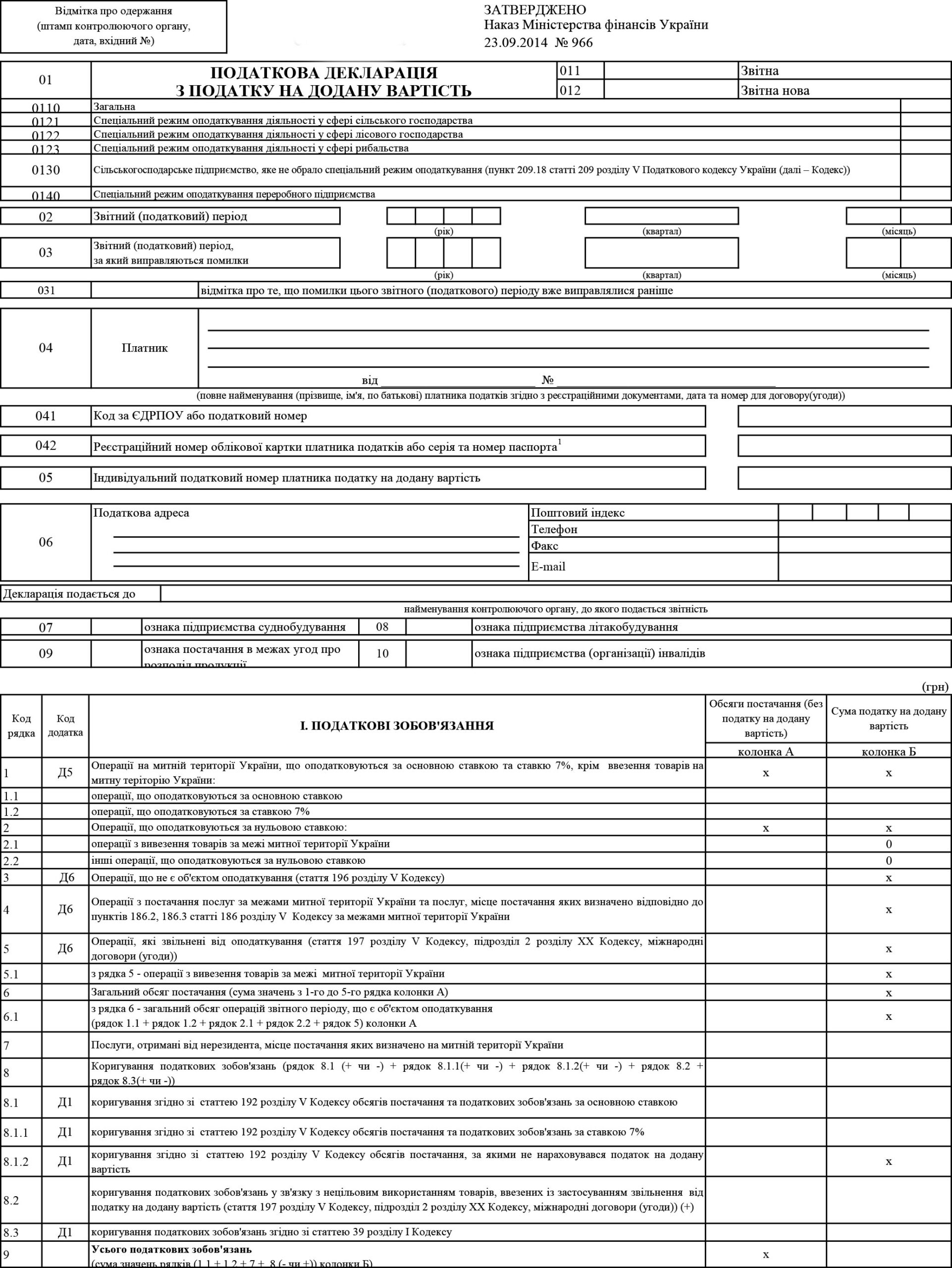

| Value added tax Section V articles 180-211 of the Tax Code, Section XX, subsection 2 of the Tax Code | Reporting period – month. Deadline for filing the report – 20 days after the end of the reporting month. Single tax payers have the option to switch to a quarterly reporting period (art.202.2 NKU). |

| Single tax Section XIV articles 291-300 of the Tax Code (NKU) | Reporting period: – year – groups 1 and 2. Filing deadline – 60 days from the end of the period; – quarter – group 3. Filing deadline – 40 days from the end of the period; – year – group 4. Calculation for the current year no later than February 20 of the current year. |

| Single contribution to the compulsory state social insurance Law № 2464, Order of the Ministry of Revenues and Duties № 454 | Reporting period: – month – for legal entities and FOPs who are tax agents. Filing deadline – by the 20th day of the month following the reporting month; – year – for FOP on the general system*, FOP on the single tax**, self-employed persons. Filing deadline – 40 days from the end date of the reporting period. |

| Excise tax Section VI articles 212-230 of the Tax Code (NKU) | Reporting period – month. Filing deadline – by the 20th day of the month following the reporting month. |

| Transport tax Section XII article 267 of the Tax Code (NKU) | Reporting period – year. Filing deadline (for legal entities) – by February 20 of the current year, and for a newly acquired object – within one month from the date of registration of rights. For individuals – the calculation is carried out by the controlling authority and a tax notice-decision is sent by July 1. |

| Land tax/rent payment Section XII articles 269-287 of the Tax Code (NKU) | Reporting period (optional) – year (with breakdown of the total amount by months in the declaration) or month (in which case the annual declaration does not need to be submitted). Filing deadline – by February 20 of the current year or monthly within 20 days from the end of the reporting month. |

| Tax on immovable property other than land Section XII article 266 of the Tax Code (NKU) | Reporting period – year. Filing deadline – by February 20 of the current year. For a newly created (introduced) object – 30 days from the date of registration of rights. For individuals – the calculation is carried out by the controlling authority and a tax notice-decision is sent by July 1. |

| Environmental tax Section VIII articles 243-250 of the Tax Code (NKU) | Reporting period – quarter. Filing deadline – 40 days from the end of the reporting quarter. |

| Rent payment for subsoil use Section IX articles 252-253 of the Tax Code (NKU) | |

| Rent payment for use of the radio frequency resource Section IX article 254 of the Tax Code (NKU) | |

| Rent payment for special water use Section IX article 255 of the Tax Code (NKU) | |

| Rent payment for special use of forest resources Section IX article 256 of the Tax Code (NKU) | |

| Rent payment for transportation of oil, gas, ammonia Law from 28.12.2014 № 71-VIII | |

| Fee for vehicle parking spaces Section XII article 268-1 of the Tax Code (NKU) | |

| Tourist tax Section XII article 268 of the Tax Code (NKU) | |

| * FOP on the general system – individuals-entrepreneurs on the general taxation system without employees. ** FOP on the single tax – individuals-entrepreneurs on the single tax without employees. | |

Download the new VAT tax declaration form: VAT 2015 Excel

Starting from January 2015 all VAT payers must submit reports in electronic form, complying with the requirements for electronic signature registration. You need to contact the Taxpayer Service Centers of the State Fiscal Service in the districts of Kyiv for free issuance of electronic keys.

From 30.01.2015 the Order of the Ministry of Finance No. 13 dated 23.01.2015 is in effect, which made changes to the previous VAT declaration form, clarifying the calculation of VAT tax liabilities in connection with the correction of self-identified errors, as well as the procedure for filling out and submitting reports.

Accordingly, starting from 01.03.2015 (reporting periods for February 2015 and the first quarter of the year) the declaration and correcting calculations must be submitted in the new form.

Highly qualified specialists of the legal company “Nakaz” will promptly prepare the necessary financial statements based on the documents provided and deliver them to the controlling authorities.