Determination of ultimate beneficial owners of legal entities and public figures (Form 4)

Law of Ukraine No.1701-VII of 14.10.2014 obliged enterprises (except those that belong to state or communal forms of ownership) and public figures to provide information about their ultimate beneficial owners. This provision applies not only to newly registered legal entities, but also to those created before the entry into force of the said Law, namely before 25.11.2014. Business entities are obliged to contact the state registrar to enter data about their ultimate beneficial owners, as well as about the ultimate beneficial owners of their founders – legal entities.

Consultation

| Service | Price |

| Amendments (standard) | from 150 USD |

| Amendments (public and non-profit) | from 150 USD |

Responsibility! Failure to comply with this requirement constitutes an administrative offense and may result in a fine imposed on the director or the authorized person of the organization in the amount of 300 to 500 non-taxable minimum incomes of citizens (from UAH 5,100 to UAH 8,500).

We emphasize that the timeframes for this procedure are extremely tight, and the rush at the state registrars complicates the task.

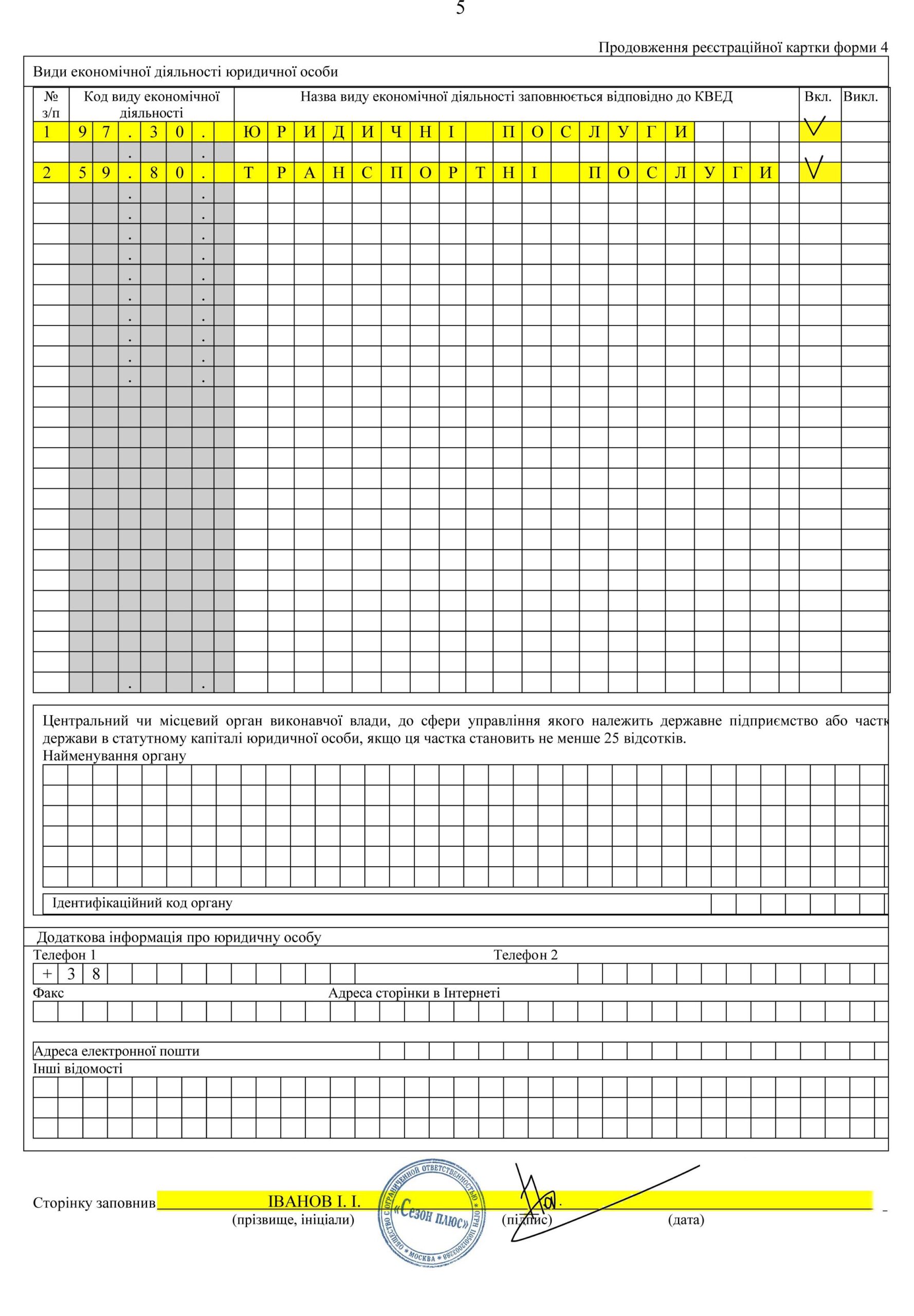

Form No.4 is completed by our specialists, who will also submit the documents about your ultimate beneficiaries to the state registrar in the shortest possible time.

The determination of the ultimate beneficiaries of a legal entity is carried out on the basis of the following data provided by you:

- name and EDRPOU code;

- passport details of the beneficiaries (if a beneficiary is a foreign citizen, a copy of the passport with a notarized translation is required);

- information about the beneficiaries’ place of residence;

- taxpayer identification number of the beneficiary (identification code) – if available;

- if a legal entity is among the founders of your company, the above data are also required concerning the founders of that legal entity;

- if the founders of the parent company also include legal entity(ies), the above data must be provided until the owners who are individuals are identified.

The ultimate beneficiary of a legal entity has the following characteristics:

- a natural person;

- owns at least 25% of the charter capital (or voting rights) alone or together with other related persons;

- exerts significant influence on the enterprise’s economic activities, including voting outcomes, determination of management, and matters concerning economic relations;

- owns or has the right to use all assets or a significant share of them;

- can make binding decisions or have managerial functions.

Thus, the information to be entered into the USR as a result of the recent changes concerns:

- the ultimate beneficiary of the enterprise;

- the ultimate beneficiary of its founder, which is a legal entity;

- the ownership structure of founders that are legal entities, in order to identify the individuals who have a significant share in the enterprise (i.e., own, including together with other related persons, at least 10% of the charter capital or voting rights).

In the further activities of the enterprise, the specified data must be monitored and, in case of changes, the state registrar must be contacted to make amendments to the USR. For this, submission of Form No.4 is provided. It should be noted that all central government authorities and their structural units are located in Kyiv, so to avoid unproductive waiting in queues, make sure the submitted documents are correct. The registrar, if there are grounds, has the right to refuse you.