Obtaining an Alcohol License in Kyiv

License to Trade Alcohol

The sale of alcohol is among the activities subject to mandatory licensing. A license to trade alcoholic beverages is an official permit certifying the holder’s right to carry out wholesale and retail trade.

The procedure for obtaining a license, its validity period, cost, and other issues are regulated by the legislation of Ukraine.

Our law firm provides services to assist in obtaining various types of licenses in Kyiv.

How to obtain an alcohol license?

License for Retail Sale of Alcoholic Beverages

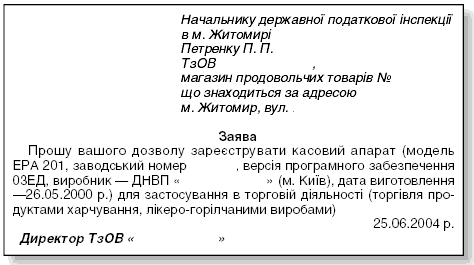

To obtain a permit for retail sale of alcoholic beverages, it is necessary to submit an application and a copy (certified by a notary or by the State Fiscal Service (GFS) authority) of the registration certificate of electronic cash registers (or books of record of settlement transactions) that are available at the retail point. All documents are submitted to the Main Department or the Taxpayers’ Service Center at the place of business. If your interests are represented by an attorney or lawyer, a power of attorney is also required to submit the documents.

| Service name | Timeframes |

| 1 working day |

| 10 working days |

The license is valid for 1 year. Note that the licensee must register it with the tax authority and, for rural areas, also with the local self-government body at the place of activity.

Keep in mind that if the warehouse for storing goods and the place of sale are at different addresses, the storage location must be entered in the Unified State Register of Storage Locations.

The price of the license for retail sale of alcoholic beverages is set by law per each declared electronic cash register (book of record of settlement transactions) available at the point of sale, and is:

- for the sale of alcoholic beverages, except cider and perry (without added alcohol) — in cities 8,000 hryvnias; in villages and settlements (except those located within city territories) 500 hryvnias;

- If a license for retail sale of alcoholic beverages is issued, a separate license is not required for the sale of cider and perry; otherwise the cost of a permit for trading cider and perry (without added alcohol) is 780 hryvnias for each sales point.

Payment is made quarterly.

License for Wholesale Trade in Alcoholic Beverages

To obtain a license for wholesale trade in alcoholic beverages, it is sufficient to submit only an application to the licensing authority. However, it should be known that suitable warehouse premises are required; information about them must be entered into the Unified State Register of Storage Locations by the business entity by submitting an application, as well as a copy of the license and a document proving the right to use the premises.

Warehouse premises where wholesale trade will be conducted must be equipped with a stand or display for product samples and cash register recorders for cash transactions with customers. It is also important to provide workstations for preparing transaction documents and to purchase equipment for verifying the authenticity of excise stamps. Minimum technical requirements for warehouse facilities assume the availability of electricity, telephone connection, security and fire alarm systems.

The license fee is established by law on an annual basis and is for trading:

- alcoholic beverages, except cider and perry (without added alcohol) – 500,000 hryvnias;

- cider and perry (without added alcohol) – 780 hryvnias.

The license is granted for 5 years. Payment is made annually.

The period for the licensing authority to make a decision to issue or to give a reasoned refusal to issue a license is 10 days from the date of submission of the necessary documents.

Entrust this work to specialists. Our company will provide you with:

- comprehensive support and full legal consultation;

- no need to visit government agencies and go through numerous bureaucratic procedures;

- qualified preparation and review of the document package with minimal involvement on your part;

- confidence in obtaining a positive result in the shortest possible time.

LEGISLATION:

Law of Ukraine “On Licensing of Types of Economic Activity” dated 02.03.2015 No. 222-VIII;

Law of Ukraine “On State Regulation of Production and Turnover of Ethyl, Cognac and Fruit Spirits, Alcoholic Beverages and Tobacco Products” dated 19.12.1995 No. 481/95-VR.