New methods of pressure from the bank

Increasingly, financial institutions (including banks) resort to various methods of intimidating their debtors over loan non-payment…

Increasingly, financial institutions (including banks) resort to any methods of intimidating their debtors for non-payment of loans. As practice shows, creditors are not at all concerned with the moral side of relations with the borrower. Often creditors exploit citizens’ legal illiteracy, skillfully wielding legal norms and actively distorting the actual state of affairs. We in no way urge borrowers not to pay their loans and do not accuse anyone. But we consider it necessary to shed light on creditors’ actions so that both parties to the relationship are familiar with their rights, and borrowers do not find themselves in an obviously unequal position compared to creditors.

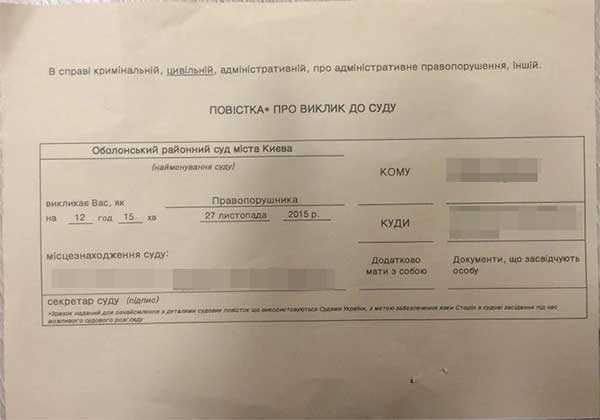

Thus, recently more and more citizens contact us because the bank sent them a court summons (or informed them by phone that it had applied to the court). In this article we give an example of a summons that ПАТ “УкрСиббанк” sent to a borrower, and an accompanying letter from the bank. These documents sent by banks (since these methods are actively used by many banks) are another way of putting pressure on debtors and absolutely do not indicate the existence of real litigation against the borrower. After all, judicial proceedings are carried out strictly according to the rules determined by the legislation of Ukraine, not by the bank.

As for the court summons, it should be noted that it is sent by the court itself, not by the bank as in this case. In addition, together with the summons the court will send a copy of the claim and the decision to open proceedings.

If such a summons came from the bank, do not assume that it has already actually applied to the court.

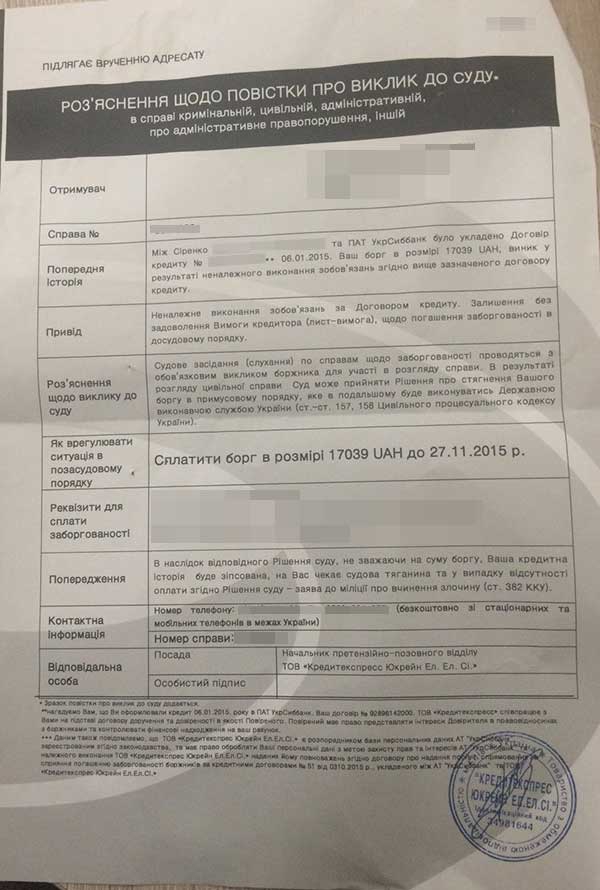

Particular attention deserves the bank letter we cited as an example – “Clarification regarding the court summons”. Let us consider it point by point:

- The bank states that to settle the dispute out of court, the debtor must pay the debt in an amount determined by the bank. Indeed, loan debt must be repaid. But often banks charge absolutely disproportionate penalties, and the loan amount grows many times over. Therefore, you should carefully recalculate the amount of the debt and be sure to consult a lawyer about the legality of the bank’s charging of all penalties.

- In the “Warning” section the bank claims that if the debt is not paid under a court decision, an application will be filed with the police about the commission of a crime (Art. 382 of the Criminal Code of Ukraine – failure to comply with a court decision). But to bring someone to criminal responsibility, guilt is required; if the debtor objectively lacks funds and property to repay the debt at that time, this is not grounds for criminal prosecution. It should also be noted that creditors very often intimidate debtors with liability for fraud. But in the usual situation, when the borrower’s financial situation has changed and they are unable to repay the debt now, this is not fraud.

Summing up. Undoubtedly, the bank has the right to go to court and sooner or later will most likely do so. But going to court entails some difficulties for the bank – it is necessary to prepare a claim, collect documents, pay the court fee and, preferably, send its representative to court. That is why such intimidation of borrowers with litigation has become more frequent. Law-abiding citizens are frightened by the very fact of court proceedings against them. In such stressful situations, debtors agree to pay the amounts that the bank has charged without considering the legality of the imposition of disproportionately large penalties.

Below are recommendations on how to check whether the bank has actually applied to the court, and who sent you the summons — the bank as psychological pressure, or whether the summons really comes from the judicial authority.

What to do if you received a court summons

On the official website of the judicial authority of Ukraine select the court at your place of registration. Note: the claim in this case is filed at the place of registration of the defendant (debtor), which is known to the bank. Therefore, if your registration has changed, you need to check information at the place of your old registration as well (the one that was indicated when signing the contract with the bank).

On the website of the court you need, in the sections “List of cases scheduled for consideration” and “List of auto-assigned cases received for the first time”, by entering your last name, check for the presence of a case (first clear the date field).

If you have difficulties checking information on the court’s website, you can clarify the data about the existence of court proceedings against you by phone or directly at the court. In addition, note that the contract between you and the bank may have specified a particular court to resolve the debt issue. Re-read your contract to identify such limitations. We also recommend checking the information on the website of the court at the location of the bank.

So, if none of the methods listed were able to identify court proceedings on your issue, most likely the bank is simply putting pressure on you, but has not yet gone to court.

If the bank has indeed filed a lawsuit, we recommend reading our article “Court with the bank – the bank filed a lawsuit over a loan”.