In December 2013 the Ministry of Revenues and Duties, by its Decree, approved the Procedure for filing complaints by taxpayers, as well as their further procedure for consideration by the Ministry of Revenues and Duties and the appeal procedure.

In December 2013 the Ministry of Revenues and Duties, by its Decree, approved the Procedure for filing complaints by taxpayers, as well as their further procedure for consideration by the Ministry of Revenues and Duties and the appeal procedure.

In its letter dated 17.01.2014 the Ministry of Revenues once again emphasizes that the Certificate of Registration of VAT payers has been abolished, and it has been replaced by an extract from the Register at the tax authorities.

Article 179 of the Labor Code and Article 18 of the Law “On Leaves” enshrine the provision according to which after the end of maternity leave a woman may take childcare leave. For the entire period of the leave the woman is paid an allowance.

The procedure for filling out payment documents prepared when transferring funds to the budget has been changed.

rn

The Ministry of Revenues and Duties reminded that, in cases provided for by law, certain goods may be restricted in movement across the customs territory of Ukraine.

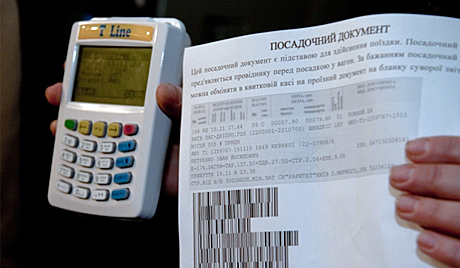

In December 2013 the Ministry of Infrastructure, by its Decree, approved changes to the Rules for the carriage of goods by road transport.

In December 2013, the Ministry of Revenues approved two new tax declaration forms, namely:

According to a comment by the Minister of Justice, Elena Lukash, in 2014 the procedure for state registration of rights to real estate will take place under a new and significantly simplified system that provides for the removal of unnecessary obstacles and the improvement of the procedure’s quality for individuals and legal entities.

The State Archival Service expressed its position on the preservation of documents in light of the adoption of the new List of typical documents indicating their retention periods.

The Ministry of Revenues once again reminded of the changes that occurred in the procedure for registering VAT payers, which came into force on January 1, 2014.

The Ministry of Revenues explained that payment for a forwarder’s services for transporting imported goods under delivery terms where the transportation costs are paid by the buyer of the goods is part of the overall transportation expenses.

At the end of 2013, the Ministry of Revenues approved by Decree No. 766 a new property tax declaration form, separate from the land plot declaration.