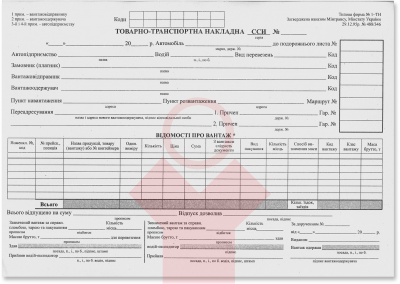

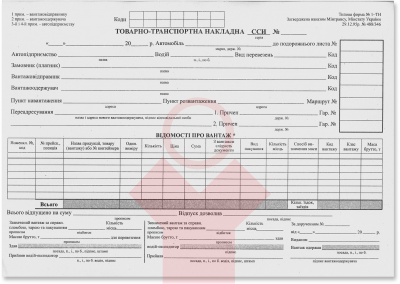

Quite often the question arises about the role of the consignment note (hereinafter – TTN) and how its absence affects tax accounting.

Quite often the question arises about the role of the consignment note (hereinafter – TTN) and how its absence affects tax accounting.

Natalia Korolevska (Minister of Social Policy) informed that, in order to use working time rationally and to create convenient conditions for celebrating the New Year and Christmas holidays, there will be a week of non-working days in 2014 (from January 1 to January 7). At the same time, the length of working time will be compensated by working on subsequent weekends.

rn

By Order No. 567 of the Ministry of Revenues and Duties of Ukraine dated 10.10.2013, the procedure for issuing a certificate confirming the absence of arrears in taxes, fees and payments controlled by the revenue authorities (hereinafter the Procedure) was approved.

At the start of 2014, innovations concerning tax benefits and accounting reporting were proposed under the Law of Ukraine №657-VII dated 24.10.2013 “On amendments to the Tax Code of Ukraine regarding the accounting and registration of taxpayers and improvement of certain provisions”.

By Resolution No. 820 of 07.11.2013 the Cabinet of Ministers of Ukraine amended the Procedure for submitting financial statements, approved by CMU Resolution No. 419 of 28.02.2000.

The Cabinet of Ministers has developed the procedure and mechanism for coordinating the conduct of simultaneous inspections (audits) by controlling authorities and state financial control bodies (CMU Resolution of 23.10.2013 No. 805).

The Tax Service reminds that an on-site inspection is conducted without prior notice to the taxpayer. At the same time, according to the provisions of the Tax Code, during the inspection officials may carry out timing of business operations.

Legal entities, in the course of their activities, sign many different contracts with other parties, as this is an important element of any business relationship. However, this process has many hidden problems that business entities are not always aware of.

The issue of not submitting Form No. 3-PN “Information on demand for labor” was considered by the Ministry of Social Policy. In its letter No. 636/021/106-13 dated 31.07.2013 the Ministry provided clarifications regarding questions in the event an employer fails to submit Form No. 3-PN to the territorial State Employment Service.

rn

In accordance with subparagraph 20.1.4 of paragraph 20.1 of Article 20 of the Tax Code of Ukraine, tax authorities have the right to carry out reconciliations and audits of taxpayers in accordance with the law, including after customs clearance or control procedures.

If the UKT VED codes for imported goods are changed or clarified after the GTD has been completed, the seller should issue not only an adjustment calculation but also a new tax invoice.

In a situation where the taxpayer makes payment of tax liabilities on the last day of the payment period after the bank’s operating hours have ended, the funds will be credited to the budget only on the next business day.