The absence of a consignment note does not affect the tax credit

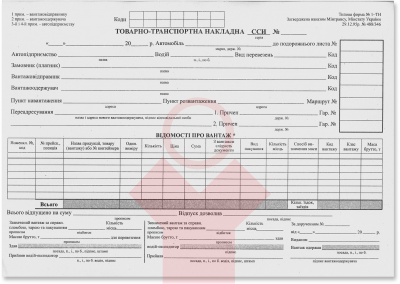

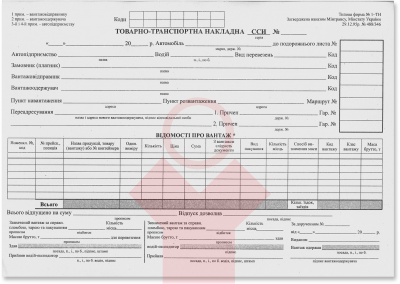

Quite often the question arises about the role of the consignment note (hereinafter – TTN) and how its absence affects tax accounting.

Quite often the question arises about the role of the consignment note (hereinafter – TTN) and how its absence affects tax accounting.

Quite often the question arises about the role of the consignment note (hereinafter – TTN) and how its absence affects tax accounting.

Based on inspections by supervisory authorities, taxpayers are often denied expenses and input tax credit in the absence of a TTN, even when primary documents for the purchase of goods are present.

In the letter dated 19.09.2013 No.11569/6/99-99-22-01-03-15/112 the Ministry of Revenues and Duties of Ukraine raised the issue of recording expenses and the right to input VAT credit in the absence (presence) of a TTN.

First of all, note that the accounting, acceptance, transfer, transportation, delivery of cargo and mutual settlements between participants in the transportation process are carried out on the basis of a set of legal documents, namely: goods-transport documentation.

The aforementioned letter explains that a tax invoice is issued to the buyer upon request by the taxpayer who carries out operations for the supply of goods (services). This document is the basis for accounting the amounts of tax attributable to the input tax credit.

The grounds for accounting tax amounts attributed to the input tax credit without receiving a tax invoice are:

- hotel bills, transport tickets and invoices issued to the taxpayer for other services;

- cash register receipts indicating the amounts of goods (services) received and the total amount of tax charged. In this case, the total amount must not exceed 200 per day (excluding VAT);

- a complaint against the supplier in case of refusal to provide the invoice, or in case of violation of the procedure for its completion (or the procedure for registration in the Unified Register.

Considering the above, for the formation of the input tax credit it is sufficient to have properly executed a tax invoice, a customs declaration, complaint letters against the supplier, or other documents provided for by Article 201 of the Tax Code of Ukraine.