By early February, legal entities that are owners of residential property should have submitted a tax declaration to the State Tax Authorities regarding immovable property …

By early February, legal entities that are owners of residential property should have submitted a tax declaration to the State Tax Authorities regarding immovable property …

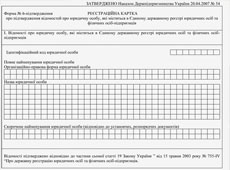

This year amendments were made to the Law “On State Registration” (dated 15.05.2003 No. 755-IV) …

The Verkhovna Rada prepared some registration and licensing adjustments, in particular it was envisaged to amend certain …

In this article we will explain to you what Form 6 (Confirmation) is, why it is needed and what will happen if it is …

In 2013 the laws and regulatory documents adopted in 2012 come into force. The new additions aim to improve …

Due to the recent order of the Ministry of Finance of Ukraine No. 1113, issued on October 24, 2012, a new amended Procedure for sending tax claims to taxpayers by the tax authorities has been established…

By Letter No. 10322/0/71-12/22-1317/1317 dated 03.12.2012 the GPSU reminds everyone that from the beginning of 2013 new rules for submitting reports to the DPS come into effect…

The State Archives Service explained to legal entities and individual entrepreneurs the procedure for destroying documentation. Whether it is necessary to destroy financial and economic…

From January 1, 2013, new simplifications for entrepreneurs come into force, which were approved pursuant to the Law of Ukraine …

In its letter dated 13.12.2012 No. 11394/0/71-12/17-1217 u00abOn the organization of worku00bb the DPS reassured entrepreneurs who did not manage in 2012 …

rn

Starting from 1 January 2013, new provisions of the Tax Code are to come into force. According to Article 39 “Methods for determining and procedure for applying …

Answers to 4 most frequently asked questions regarding the calculation of income of single tax payers …