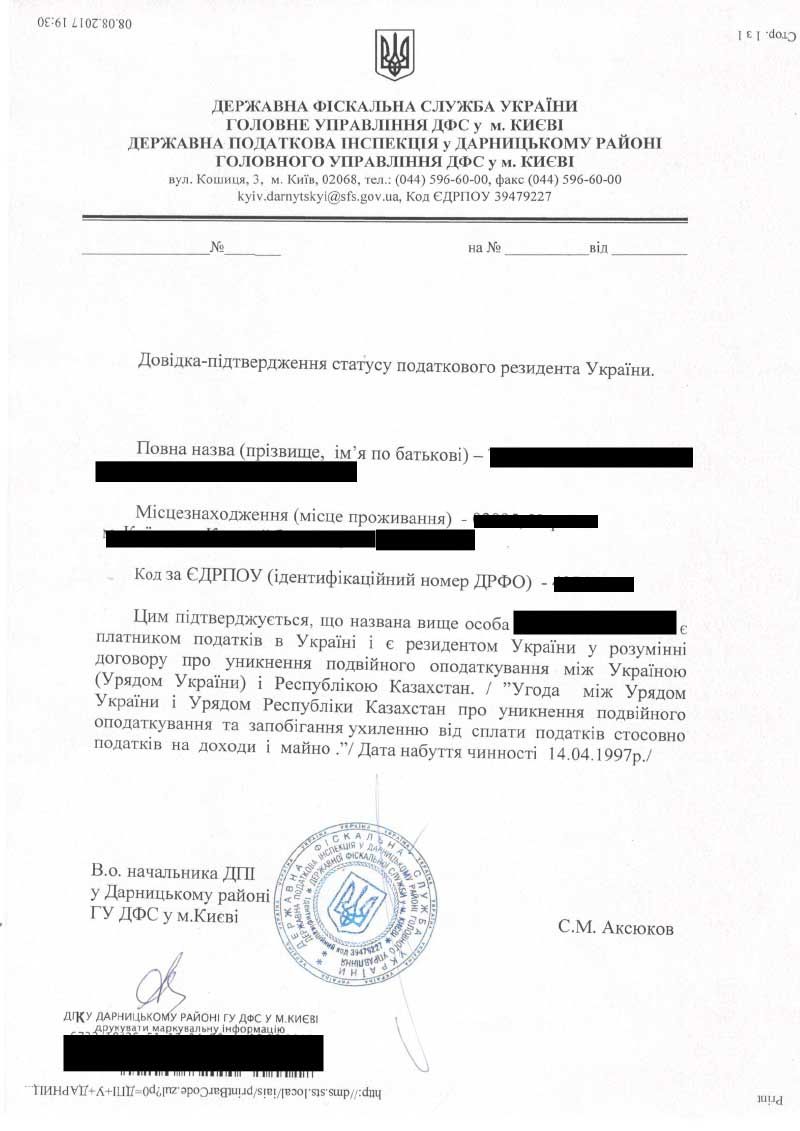

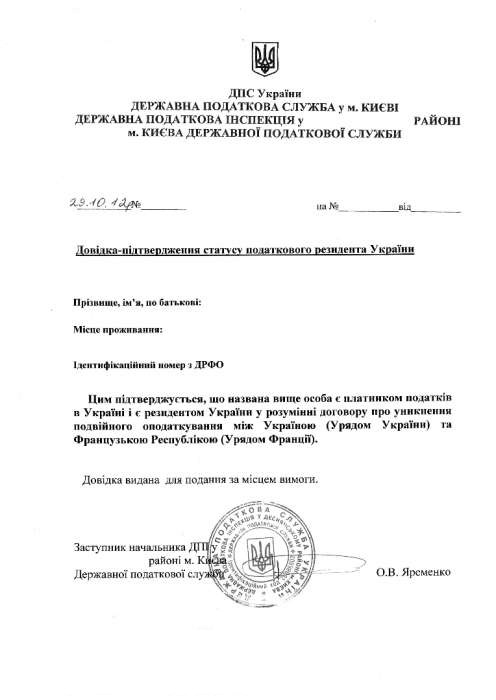

Obtaining a Certificate Confirming Tax Residency Status

| Service | Timeframe | Price (UAH) |

|---|---|---|

| Tax Residency Certificate of Ukraine Kyiv (for Ukrainian citizens) | 10 working days | 100 USD |

| Tax Residency Certificate of Ukraine other city (for Ukrainian citizens) | 12 working days | 150 USD |

| Tax Residency Certificate of Ukraine (for foreigners) | 14 working days | 450 USD |

| Apostille on the Tax Residency Certificate of Ukraine | 5-10 working days | 50 USD |

* a power of attorney is required from the client

There are international agreements among 57 countries worldwide (including Ukraine) to prevent the same income from being taxed twice in two different countries. To avoid double taxation, citizens who receive income outside Ukraine must confirm their status as a tax resident of Ukraine. Issuance of a tax residency certificate usually takes 10 days from the date of application to the tax authority. After this period, the tax authority is obliged to issue a certificate in the approved form confirming the status of a tax resident of Ukraine.

Not only a citizen of Ukraine can be recognized as a resident. A person may be considered a resident if they have close economic and personal ties in Ukraine. For example, a person engaged in entrepreneurial activity who pays the single tax in Ukraine, or if members of their family permanently reside here, may be recognized as a resident.

If a person has dual citizenship, for tax purposes that person will be considered a citizen of Ukraine and will have the right to a credit for taxes paid abroad.

Registration of enterprises as residents is carried out only if they are located on the territory of Ukraine and conduct their activities under the legislation of our country. If a legal entity has a tax residency certificate, then taxation of entrepreneurs will be applied at a rate of 15%. Without this document, the income tax rate will be 30%.

If income in Ukraine is received by a non-resident individual or legal entity, such an entity must present a certificate that confirms it is a resident of the country with which an international agreement has been concluded. In the absence of such a document, tax will be withheld for the budget of Ukraine. It should be remembered that registration as a tax resident is not permanent and is valid for one year from the date of issue.

Our company’s specialists can assist in obtaining a tax residency certificate for both Ukrainian citizens and foreigners. In addition, our lawyers can provide the following related services:

- registration of a foreign national as an individual entrepreneur;

- obtaining a residence permit;

- trademark registration;

- business registration;

- registration of a foreign citizen with the OVIR;

- obtaining an identification code;

- work permit for a foreigner;

- obtaining a foreign passport;

- licensing of entrepreneurial activity;

- re-issuance of licenses;

- emigration for permanent residence from Ukraine;

- product certification;

- we provide consulting for non-profit organizations;

- other services.